Navigating the Commercial Real Estate Landscape: Understanding the 2023 Deal Volume Decline

Posted: April 9th, 2024

In the realm of commercial real estate, the past year witnessed a substantial and concerning decline in deal volume, echoing a historical downturn reminiscent of the Global Financial Crisis. MSCI Real Assets' latest data reveals a stark 51% year-over-year decrease in sales, marking a plunge not witnessed since the aforementioned crisis. Across all property sectors, there was a noteworthy double-digit reduction in...

Read MoreNavigating the Housing Affordability Crisis: Insights from First American

Posted: March 25th, 2024

As a mortgage broker, I've observed a concerning trend in the housing market that is impacting affordability for buyers. Despite some relief in mortgage rates, home prices continue to surge, making it increasingly difficult for potential buyers to enter the market. Based on data from First American Financial Corp., affordability in November hit a historic low not seen in over thirty years. The Real House Price...

Read MoreNew Home Sales Surge: Bright Outlook for 2024

Posted: March 19th, 2024

Amidst a backdrop of moderating mortgage rates, December witnessed a notable rebound in new home sales, instilling optimism among experts and builders for the trajectory of 2024. According to data from the U.S. Census Bureau and the Department of Housing and Urban Development, new home sales surged by 8.0% in December, reaching a seasonally adjusted annual rate of 664,000 units. This increase, both month over...

Read MoreThe Rising Hurdle: High Interest Rates Overtake Home Prices as the Biggest Affordability Challenge.

Posted: February 1st, 2024

As the housing market continues to pose challenges for potential homeowners, a recent survey by Fannie Mae reveals a growing sense of pessimism among consumers. According to the Home Purchase Sentiment Index (HPSI), mortgage rates have now surpassed home prices as the primary obstacle to achieving homeownership. In September, the HPSI declined by 2.4 points, reaching a reading of 64.5. This decline was driven by a...

Read MoreProposed CRA Rule Reform May Reshape Bank Lending Landscape.

Posted: January 22nd, 2024

In a potentially transformative move, federal regulators have unveiled a draft final rule to modernize the Community Reinvestment Act (CRA), a federal law enacted in 1977 to encourage banks to meet the diverse needs of borrowers, particularly in low- and moderate-income areas. The proposed changes come as a response to the rise of online and mobile banking, prompting regulators to redefine the criteria for...

Read MoreReal Estate Investors Riding High: Investors Stay Positive Despite Tough Market Conditions, RCN Capital Survey Reveals.

Posted: January 15th, 2024

The Fall 2023 Investor Sentiment Survey from RCN Capital revealed that investors remain optimistic about the future of the residential real estate market, even in a time marred by numerous challenging conditions. This optimism is encouraging, as it indicates that investors believe there are positive prospects for growth and success within this sector despite headwinds. By investing carefully and with confidence...

Read MoreSurge in New Home Sales and Price Decline in September: A Mortgage Broker's Perspective

Posted: January 9th, 2024

Hello, In a surprising turn of events, new home sales soared to a 19-month high in September, erasing the previous month's decline and marking a significant 12.3% month-over-month increase. The persistent shortage of resale supply seems to be driving buyers towards new builds, even as mortgage rates approach 8%. According to data from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development...

Read MoreMohawk Mortgage Man's Monthly Market Update: Mortgage Surge & Lower Rates.

Posted: December 12th, 2023

Hello! “Mortgage originations are increasing as interest rates drop as a result of the recession, excellent news for prospective homeowners as we start a new year!” The Mortgage Bankers Association (MBA) recently released a housing market forecast, predicting a surge in mortgage originations for 2024. According to the MBA, mortgage originations are estimated to reach 5.2 million loans next year...

Read MoreTwo Questions To Ask Yourself if You’re Considering Buying a Home

Posted: July 6th, 2023

If you’re thinking of buying a home, chances are you’re paying attention to just about everything you hear about the housing market. And you’re getting your information from a variety of channels: the news, social media, your real estate agent, conversations with friends and loved ones, overhearing someone chatting at the local supermarket, the list goes on and on. Most likely, home prices...

Read MoreAmericans Still View Homeownership as the American Dream

Posted: July 6th, 2023

Everyone’s interpretation of the American Dream is unique and personal. But, for many people, it’s tied to a sense of success, freedom, and prosperity. These are all things that owning a home can help provide. A recent survey from Bankrate asked respondents which achievements they feel most embody the American Dream. The responses prove owning a home is still important to so many Americans...

Read MoreEvaluating Your Wants and Needs as a Homebuyer Matters More Today

Posted: July 3rd, 2023

When it comes to buying a home, especially with today’s affordability challenges, you’ll want to be strategic. Mortgage rates impact how much it costs to borrow money for your home loan. And, to help offset the higher borrowing costs today, some homebuyers are taking a close look at their wish list and re-evaluating what features they really need in their next home to...

Read MoreWhere Will You Go If You Sell? Newly Built Homes Might Be the Answer.

Posted: July 3rd, 2023

Do you want to sell your house, but hesitate because you’re worried you won’t be able to find your next home in today’s market? You're not alone, but there’s some good news that may ease your worries. New home construction is up and is becoming an increasingly significant part of the housing inventory. That means when you go to put your house on the market...

Read MoreLending Standards Are Not Like They Were Leading Up to the Crash

Posted: July 3rd, 2023

You might be worried we’re heading for a housing crash, but there are many reasons why this housing market isn’t like the one we saw in 2008. One of which is how lending standards are different today. Here’s a look at the data to help prove it. Every month, the Mortgage Bankers Association (MBA) releases the Mortgage Credit Availability Index (MCAI)...

Read MoreWhy Homeownership Wins in the Long Run

Posted: June 27th, 2023

Today’s higher mortgage rates, inflationary pressures, and concerns about a potential recession have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to think about the long-term benefits of homeownership when making your decision. Consider this: if you know people...

Read MoreThe True Cost of Selling Your House on Your Own

Posted: June 26th, 2023

Selling your house is no simple task. While some homeowners opt to sell their homes on their own, known as a FSBO (For Sale by Owner), they often encounter various challenges without the guidance of a real estate agent. If you’re currently considering selling your house on your own, here’s what you should know. The most recent Profile of Home Buyers and Sellers from the National...

Read MoreWhat Homebuyers Need To Know About Credit Scores

Posted: June 23rd, 2023

If you’re thinking about buying a home, you should know your credit score’s a critical piece of the puzzle when it comes to qualifying for a home loan. Lenders review your credit to assess your ability to make payments on time, pay back debts, and more. It’s also a factor that helps determine your mortgage rate. An article from Bankrate explains: “Your credit score...

Read MoreEco-Friendly, Energy-Efficient Homes Attract Buyers

Posted: June 23rd, 2023

Are you planning to sell your house? If so, you may be surprised to hear just how much buyers value energy efficiency and eco-friendly features today. This is especially true as summer officially kicks off. In fact, the 2023 Realtors and Sustainability Report from the National Association of Realtors (NAR) shows 48% of agents or brokers have noticed consumers are interested...

Read MoreWhy Buying or Selling a Home Helps the Economy and Your Community

Posted: June 20th, 2023

If you're thinking about buying or selling a house, it's important to know that it doesn't just affect your life, but also your community. The National Association of Realtors (NAR) releases a report every year to show how much economic activity is generated by home sales. The chart below illustrates that impact: As the visual shows, when a house is sold, it can make a...

Read MoreWhy the Median Home Price Is Meaningless in Today’s Market

Posted: June 20th, 2023

The National Association of Realtors (NAR) will release its latest Existing Home Sales (EHS) report later this week. This monthly report provides information on the sales volume and price trend for previously owned homes. In the upcoming release, it’ll likely say home prices are down. This may feel a bit confusing, especially if you’ve been following along and seeing the...

Read MoreSaving for a Down Payment? Here’s What You Need To Know.

Posted: June 20th, 2023

If you're planning to buy your first home, then you're probably focused on saving for all the costs involved in such a big purchase. One of the expenses that may be at the top of your mind is your down payment. If you’re intimidated by how much you need to save for that, it may be because you believe you must put 20% down. That doesn’t necessarily have to be the case. As the National...

Read MoreA Drop in Equity Doesn’t Mean Low Equity

Posted: June 15th, 2023

You may see media coverage talking about a drop in homeowner equity. What’s important to understand is that equity is tied closely to home values. So, when home prices appreciate, you can expect equity to grow. And when home prices decline, equity does too. Here’s how this has played out recently. Home prices rose rapidly during the ‘unicorn’ years. That gave homeowners a...

Read MoreYour Needs Matter More Than Today’s Mortgage Rates

Posted: June 13th, 2023

If you’re thinking about selling your house right now, chances are it’s because something in your life has changed. And, while things like mortgage rates are a key part of your decision on what you’ll buy next, it’s important to not lose sight of the reason you want to make a change in the first place. It’s true mortgage rates have climbed from the record...

Read MoreAre Home Prices Going Up or Down? That Depends…

Posted: June 13th, 2023

Media coverage about what’s happening with home prices can be confusing. A large part of that is due to the type of data being used and what they’re choosing to draw attention to. For home prices, there are two different methods used to compare home prices over different time periods: year-over-year (Y-O-Y) and month-over-month (M-O-M). Here's an explanation of each. Year-over-Year (Y-O-Y): This...

Read MoreThe Main Reason Mortgage Rates Are So High

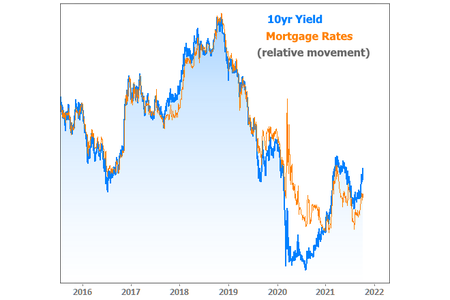

Posted: June 8th, 2023

Today’s mortgage rates are top-of-mind for many homebuyers right now. As a result, if you’re thinking about buying for the first time or selling your current house to move into a home that better fits your needs, you may be asking yourself these two questions: Why Are Mortgage Rates So High? When Will Rates Go Back Down? Here’s context you need to help answer those questions. 1...

Read MoreThis Real Estate Market Is the Strongest of Our Lifetime

Posted: June 8th, 2023

When you look at the numbers today, the one thing that stands out is the strength of this housing market. We can see this is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime. Here are two fundamentals that prove this point. 1. The Current Mortgage Rate on Existing Mortgages First, let’s look at the current rate...

Read MoreReal Estate Is Still Considered the Best Long-Term Investment

Posted: June 7th, 2023

With all the headlines circulating about home prices and rising mortgage rates, you may wonder if it still makes sense to invest in homeownership right now. A recent poll from Gallup shows the answer is yes. In fact, real estate was voted the best long-term investment for the 11th consecutive year, consistently beating other investment types like gold, stocks, and bonds (see...

Read MoreOops! Home Prices Didn’t Crash After All

Posted: June 5th, 2023

During the fourth quarter of last year, many housing experts predicted home prices were going to crash this year. Here are a few of those forecasts: Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business: “I expect housing prices fall 10% to 15%, and the housing prices are accelerating on the downside.” Mark Zandi, Chief Economist...

Read MoreThe True Value of Homeownership

Posted: June 1st, 2023

Buying and owning your home can make a big difference in your life by bringing you joy and a sense of belonging. And with June being National Homeownership Month, it’s the perfect time to think about all the benefits homeownership provides. Of course, there are financial reasons to buy a house, but it’s important to consider the non-financial benefits that make a home more than just...

Read MoreKeys to Success for First-Time Homebuyers

Posted: May 31st, 2023

Buying your first home is an exciting decision and a major milestone that has the power to change your life for the better. As a first-time homebuyer, it’s a vision you can bring to life, but, as the National Association of Realtors (NAR) shares, you’ll have to overcome some factors that have made it more challenging in recent years: “Since 2011, the share of first-time...

Read MoreToday’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

Posted: May 30th, 2023

Comparing real estate metrics from one year to another can be challenging in a normal housing market. That’s due to possible variability in the market making the comparison less meaningful or accurate. Unpredictable events can have a significant impact on the circumstances and outcomes being compared. Comparing this year’s numbers to the two ‘unicorn’ years we just experienced is...

Read MoreThe Benefits of Selling Now, According to Experts

Posted: May 25th, 2023

If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale. And, with so few homes on the market, buyers will have fewer options, so you set yourself up to get the most...

Read MoreOwning a Home Helps Protect Against Inflation

Posted: May 25th, 2023

You’re probably feeling the impact of high inflation every day as prices have gone up on groceries, gas, and more. If you’re a renter, you’re likely experiencing it a lot as your rent continues to rise. Between all of those elevated costs and uncertainty about a potential recession, you may be wondering if it still makes sense to buy a home today. The short answer is – it does...

Read MoreWhy Buying a Vacation Home Beats Renting One This Summer

Posted: May 23rd, 2023

For many of us, visiting the same vacation spot every year is a summer tradition that’s fun, relaxing, and restful. If that sounds like you, now’s the time to consider your plans and determine if buying a vacation home this year makes more sense than renting one again. According to Forbes: “. . . if the idea of vacationing at the same place every year makes you feel...

Read MoreWhy Buyers Need an Expert Agent by Their Side

Posted: May 23rd, 2023

The process of buying a home can feel a bit intimidating, even under normal circumstances. But today's market is still anything but normal. There continues to be a very limited number of homes for sale, and that’s creating bidding wars and driving home prices back up as buyers compete over the available homes. Navigating all of this can be daunting if you’re trying to do it...

Read MorePowerful Job Market Fuels Homebuyer Demand

Posted: May 19th, 2023

The spring housing market has been surprisingly active this year. Even with affordability challenges and a limited number of homes for sale, buyer demand is strong and getting stronger. One way we know there are interested buyers right now is because showing traffic is up. Data from the latest ShowingTime Showing Index, which is a measure of buyers actively touring homes, makes...

Read MoreWhat You Need To Know About Home Price News

Posted: May 19th, 2023

The National Association of Realtors (NAR) will release its latest Existing Home Sales Report tomorrow. The information it contains on home prices may cause some confusion and could even generate some troubling headlines. This all stems from the fact that NAR will report the median sales price, while other home price indices report repeat sales prices. The vast majority of...

Read MoreThe Worst Home Price Declines Are Behind Us

Posted: May 16th, 2023

If you’re following the news today, you may feel a bit unsure about what’s happening with home prices and fear whether or not the worst is yet to come. That’s because today’s headlines are painting an unnecessarily negative picture. Contrary to those headlines, home prices aren’t in a freefall. The latest data tell a very different and much more positive...

Read MoreHomeowners Have Incredible Equity To Leverage Right Now

Posted: May 16th, 2023

Even though home prices have moderated over the last year, many homeowners still have an incredible amount of equity. But what is equity? In the simplest terms, equity is the difference between the market value of your home and the amount you owe on your mortgage. The National Association of Realtors (NAR) explains how your equity grows over time: “Housing wealth (home equity or...

Read MoreThe Best Time To Sell Your House Is When Others Aren’t Selling

Posted: May 12th, 2023

If you’re thinking about selling your house, you should know the number of homes for sale right now is low. That’s because, this season, there are fewer sellers listing their houses for sale than the norm. Looking back at every April since 2017, the only year when fewer sellers listed their homes was in April 2020, when the pandemic hit and stalled the housing market (shown in...

Read MoreThe Impact of Inflation on Mortgage Rates

Posted: May 10th, 2023

If you’re reading headlines about inflation or mortgage rates, you may see something about the recent decision from the Federal Reserve (the Fed). But what does it mean for you, the housing market, and your plans to buy a home? Here’s what you need to know. Inflation and the Housing Market While the Fed’s working hard to lower inflation, the latest data shows...

Read MoreWhy Today’s Housing Market Is Not About To Crashc

Posted: May 9th, 2023

There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to understand why that worry has come up. But the data clearly shows today’s market is very different than it was before the housing crash in 2008. Rest assured...

Read MoreIt May Be Time To Consider a Newly Built Home

Posted: May 8th, 2023

If you’re looking to buy a house, you may find today’s limited supply of homes available for sale challenging. When housing inventory is as low as it is right now, it can feel like a bit of an uphill battle to find the perfect home for you because there just isn’t that much to choose from. If you need to open up your pool of options, it may be time to consider a newly built home...

Read MoreHow Homeowners Win When They Downsize

Posted: May 8th, 2023

Downsizing has long been a popular option when homeowners reach retirement age. But there are plenty of other life changes that could make downsizing worthwhile. Homeowners who have experienced a change in their lives or no longer feel like their house fits their needs may benefit from downsizing too. U.S. News explains: “Downsizing is somewhat common among older...

Read MoreBuyer Activity Is Up Despite Higher Mortgage Rates

Posted: May 8th, 2023

If you’re a homeowner thinking about making a move, you may wonder if it’s still a good time to sell your house. Here’s the good news. Even with higher mortgage rates, buyer traffic is actually picking up speed. Data from the latest ShowingTime Showing Index, which is a measure of buyers actively touring homes, helps paint the picture of how much buyer demand has...

Read MoreA Recession Doesn’t Equal a Housing Crisis

Posted: May 8th, 2023

Everywhere you look, people are talking about a potential recession. And if you’re planning to buy or sell a house, this may leave you wondering if your plans are still a wise move. To help ease your mind, experts are saying that if we do officially enter a recession, it’ll be mild and short. As the Federal Reserve explained in their March meeting: “. . . the staff’s...

Read MoreWhy Buying a Home Makes More Sense Than Renting Today

Posted: May 1st, 2023

Wondering if you should continue renting or if you should buy a home this year? If so, consider this. Rental affordability is still a challenge and has been for years. That’s because, historically, rents trend up over time. Data from the Census shows rents have been climbing pretty steadily since 1988. And, data from the latest rental...

Read MoreWhy Today's Foreclosure Numbers Are Nothing Like 2008

Posted: April 28th, 2023

You’ve likely seen headlines about the number of foreclosures climbing in today’s housing market. That may leave you with a few questions, especially if you’re thinking about buying a house. Understanding what they really mean is mission-critical if you want to know the truth about what’s happening today. According to a recent report from ATTOM, a property data provider...

Read MoreThe Three Factors Affecting Home Affordability Today

Posted: April 26th, 2023

There’s been a lot of focus on higher mortgage rates and how they’re creating affordability challenges for today’s homebuyers. It’s true that rates climbed dramatically since the record-low we saw during the pandemic. But home affordability is based on more than just mortgage rates – it’s determined by a combination of mortgage rates, home prices, and wages...

Read MoreWhat Are the Experts Saying About the Spring Housing Market?

Posted: April 25th, 2023

The housing market’s been going through a lot of change lately, and there’s been uncertainty surrounding what will happen this spring. You may be wondering if more homes will go on the market, what’s next with home prices and mortgage rates, or what the best advice is for someone in your position right now. Here’s what industry experts are saying right now about the spring...

Read MoreThe Power of Pre-Approval

Posted: April 24th, 2023

If you’re buying a home this spring, today’s housing market can feel like a challenge. With so few homes on the market right now, plus higher mortgage rates, it’s essential to have a firm grasp on your homebuying budget. You’ll also need a sense of determination to find the right house and act quickly when you go to put in an offer. One thing you can do to help you prepare is to...

Read MoreWhat’s the Difference Between a Home Inspection and an Appraisal?

Posted: April 21st, 2023

If you’re planning to buy a home, an inspection is an important step in the process. It assesses the condition of the home before you finalize the transaction. It’s also a different step in the process from an appraisal, which is a professional evaluation of the market value of the home you’d like to buy. In most cases, an appraisal is ordered by the lender to confirm or verify the value of...

Read MoreFalling out of Love with Your House? It May Be Time To Move.

Posted: April 19th, 2023

Owning a home means having a place that’s solely your own and provides the space, features, and location you and your loved ones need. But what happens when your needs change? If this hits home for you, it may be time to make a move. According to the latest Home Buyers and Sellers Generational Trends Report from the National Association of Realtors (NAR), the average person has lived...

Read More5 Reasons Millennials Are Buying Homes

Posted: April 19th, 2023

In the United States, there are over 72 million millennials. If you’re part of that generation and have thought about buying a home, you aren’t alone. According to Zonda, 98% of millennials want to become a homeowner at some point if they aren’t already. But why? There are plenty of reasons you may choose to become a homeowner. Here’s why other millennials...

Read MoreThink Twice Before Waiting for Lower Home Prices

Posted: April 17th, 2023

As the housing market continues to change, you may be wondering where it’ll go from here. One factor you’re probably thinking about is home prices, which have come down a bit since they peaked last June. And you’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop...

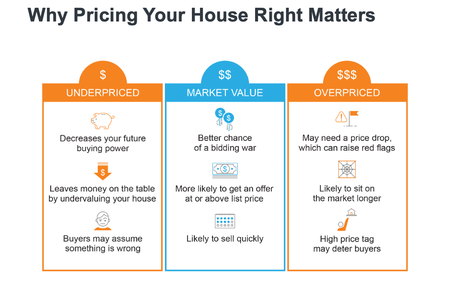

Read MoreWant To Sell Your House This Spring? Price It Right.

Posted: April 14th, 2023

Over the last year, the housing market’s gone through significant changes. While it’s still a sellers’ market, homes that are priced right are selling, and they get the most attention from buyers right now. If you’re thinking of selling your house this spring, it’s important to lean on your expert real estate advisor when it comes to setting a list price...

Read MoreYour Tax Refund Can Help You Achieve Your Homebuying Goals

Posted: April 14th, 2023

Have you been saving up to buy a home this year? If so, you know there are a variety of expenses involved – from your down payment to closing costs. But there’s good news – your tax refund can help you achieve your goals by paying for some of these expenses. SmartAsset estimates the average American will receive a $1,798 tax refund this year. The map below provides a...

Read MoreThe Big Advantage If You Sell This Spring

Posted: April 14th, 2023

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low. HousingWire shares: “. . . the big question is whether we are finally starting to see the seasonal spring increase in inventory. The answer is no, because active listings fell to a new low last week for 2023 . . .” The National Association...

Read MoreHomebuyer Activity Shows Signs of Warming Up for Spring

Posted: April 10th, 2023

The spring season appears to be warming up in housing as more and more buyers enter the market. And after rising mortgage rates sidelined so many buyers last year, that’s a good sign for sellers. Realtor.com has the latest: “Spring is officially here, and like green shoots emerging from the bleak winter, new data suggests that more buyers are back in the market...

Read MoreTrying To Buy a Home? Hang in There.

Posted: April 10th, 2023

We’re still in a sellers’ market. And if you’re looking to buy a home, that means you’re likely facing some unique challenges, like difficulty finding a home and volatile mortgage rates. But keep in mind, there are some benefits to being a buyer in today’s market that give you good reason to stick with your search. Here are a few of them. Long-Term Benefits Outweigh Short-Term...

Read MoreWhy Aren’t Home Prices Crashing?

Posted: April 5th, 2023

There have been a lot of shifts in the housing market recently. Mortgage rates rose dramatically last year, impacting many people’s ability to buy a home. And after several years of rapid price appreciation, home prices finally peaked last summer. These changes led to a rise in headlines saying prices would end up crashing. Even though we’re no longer seeing the buyer frenzy that drove home values up...

Read MoreHow Changing Mortgage Rates Can Affect You

Posted: April 3rd, 2023

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power. The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment: Even a 0.5% change can have a big impact...

Read MoreFacts About Closing Costs [INFOGRAPHIC]

Posted: April 3rd, 2023

Some Highlights If you’re thinking about buying a home, be sure to plan for closing costs. Closing costs are typically 2% to 5% of the total purchase price of a home, and they can include things like government recording costs, appraisal fees, and more. Let’s connect so I can answer your questions about the home-buying process.

Read MoreWe’re in a Sellers’ Market. What Does That Mean?

Posted: March 30th, 2023

Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today so good if you want to list your house? It starts with the number of homes available for sale. The latest Existing Home Sales Report from the National...

Read More4 Key Tips for Selling Your House This Spring

Posted: March 29th, 2023

Spring has arrived, and that means more and more people are getting their homes ready to sell. But with recent shifts in real estate, this year’s spring housing market will be different from the frenzy of the past several years. To sell your house quickly, without hassles, and for the most money, be sure to follow these four simple tips: 1. Make Sure You Give Buyers Access One of the biggest...

Read MoreHow Homeownership Is Life Changing for Many Women

Posted: March 29th, 2023

Throughout Women’s History Month, we reflect on the impact women have in our lives, and that includes the impact on the housing market. In fact, since at least 1981, single women have bought more homes than single men each year, and they make up 17% of all households. Why Is Homeownership So Important to Women? The rise in women pursuing homeownership hasn’t just made an impact...

Read MoreGet Ready: The Best Time To List Your House Is Almost Here

Posted: March 27th, 2023

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching. Experts at realtor.com looked at seasonal trends from recent years (excluding 2020 as an uncharacteristic year due to the onset of the pandemic) and determined the ideal week to list a house this year: “Home sellers on the fence waiting for that...

Read MoreHave You Thought About Why You Might Want To Sell Your House? [INFOGRAPHIC]

Posted: March 27th, 2023

Some Highlights If you’re on the fence about selling your house, it’s worth considering all the reasons why moving could make sense for you. If you find your home no longer meets your needs, it may be time to sell. You have a lot to consider when deciding if you should move. Let’s connect today to go...

Read MoreWhy Buying a Home Is a Sound Decision

Posted: March 23rd, 2023

If you’re thinking about buying a home, you want to know the decision will be a good one. And for many, that means thinking about what home prices are projected to do in the coming years and how that could impact your investment. This year, we aren’t seeing home prices fall dramatically. As the year goes on, however, some markets may go up in value while others may lose...

Read MoreReasons To Consider Condos in Your Home Search

Posted: March 23rd, 2023

Are you having trouble finding a home that fits your needs and your budget? If so, you should know there’s an option worth considering – condominiums, also known as condos. According to Bankrate: “A condo can be a more affordable entry point to homeownership than a single-family home. And as a homeowner, you’ll build equity over time and have access to tax...

Read MoreThe Role of Access in Selling Your House

Posted: March 21st, 2023

Once you’ve made the decision to sell your house and have hired a real estate agent to help, they’ll ask how much access to your home you want to give potential buyers. Your answer matters more now than it did in recent years. Here’s why. At the height of the buying frenzy seen during the pandemic, there was a rise in the number of homebuyers who put offers on houses...

Read MoreWhat’s Ahead for Home Prices in 2023

Posted: March 20th, 2023

Over the past year, home prices have been a widely debated topic. Some have said we’ll see a massive drop in prices and that this could be a repeat of 2008 – which hasn’t happened. Others have forecasted a real estate market that could see slight appreciation or depreciation depending on the area of the country. And as we get closer to the spring real estate market, experts are continuing to...

Read MoreWhat Buyer Activity Tells Us About the Housing Market

Posted: March 16th, 2023

Though the housing market is no longer experiencing the frenzy of a year ago, buyers are showing their interest in purchasing a home. According to U.S. News: “Housing markets have cooled slightly, but demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.” That activity can be seen in the latest ShowingTime Showing...

Read MoreBalancing Your Wants and Needs as a Homebuyer This Spring

Posted: March 16th, 2023

Though there are more homes for sale now than there were at this time last year, there’s still an undersupply with fewer houses available than in more normal, pre-pandemic years. The Monthly Housing Market Trends Report from realtor.com puts it this way: “While the number of homes for sale is increasing, it is still 43.2% lower than it was before the pandemic in...

Read MoreAn Expert Gives You Clarity in Today’s Housing Market

Posted: March 14th, 2023

The housing market has been going through shifts lately. That’s why it’s so important to work with an industry professional who can be your guide throughout the process. Real estate expert uses their knowledge of what’s really happening with home prices, housing supply, expert projections, and more to give you the best advice. Someone who can provide clarity like that is...

Read MoreLeverage Your Equity When You Sell Your House

Posted: March 13th, 2023

One of the benefits of being a homeowner is that you build equity over time. By selling your house, that equity can be used toward purchasing your next home. But before you can put it to use, you should understand exactly what equity is and how it grows. Bankrate explains it like this: “Home equity is the portion of your home you’ve paid off – in other words, your stake...

Read More4 Tips for Making Your Best Offer on a Home

Posted: March 9th, 2023

Are you planning to buy a home this spring? Though things are more balanced than they were at the height of the pandemic, it’s still a sellers’ market. So, when you find the home you want to buy, remember these four tips to make your best offer. 1.Lean on a Real Estate Professional Rely on an agent who can support your goals. As Bankrate notes: “. . . select the best real...

Read More2 Things Sellers Need To Know This Spring.

Posted: March 8th, 2023

A lot has changed over the past year, and you might be wondering what’s in store for the spring housing market. If you’re planning to sell your house this season, here’s what real estate experts are saying you should keep in mind. 1. Houses That Are Priced Right Are Still Selling Houses that are updated and priced at their current market value are still selling. Jeff Tucker, Senior...

Read MoreCould a Multigenerational Home Be the Right Fit for You?

Posted: March 7th, 2023

During the pandemic, many of us reexamined the meaning of home for ourselves and our loved ones. Today, that can be seen in the recent rise in multigenerational households. According to Jessica Lautz, Deputy Chief Economist and Vice President of Economic Research at the National Association of Realtors (NAR): “Multi-generational buying may be a home where families live...

Read MoreWhere Will You Go After You Sell Your House? [INFOGRAPHIC]

Posted: March 7th, 2023

Some Highlights If you’re thinking of selling your house, be sure to explore all the options you have for your next home. Both newly built homes and existing homes offer plenty of unique benefits. If you have questions about the options in our area, let’s discuss what’s available and what’s right for you

Read MoreIs It Really Better To Rent Than To Own a Home Right Now?

Posted: March 7th, 2023

You may have seen reports in the news recently saying it’s better to rent right now than it is to own your home. But before you let that impact your decisions, you should understand what these claims are based on. A lot of the time, these reports are assuming things that aren’t realistic for the average household. For example, the methodology behind one of those reports says that renting...

Read MoreEquity Gains for Today’s Homeowners

Posted: March 2nd, 2023

Today’s homeowners are sitting on significant equity, even as home price appreciation has eased recently. If you’re a homeowner, your net worth got a boost over the past few years thanks to rising home prices. Here’s what it means for you, even as the market moderates. How Equity Has Grown in Recent Years Because of the imbalance between how many homes were for sale and...

Read MoreAn Expert Makes All the Difference When You Sell Your House

Posted: March 1st, 2023

If you’re thinking of selling your house, it’s important to work with someone who understands how the market is changing and what it means for you. Here are five reasons working with a professional can ensure you’ll get the most out of your sale. 1. They’re Experts on Market Trends With today’s housing market defined by change, it’s critical to work with someone who...

Read MoreWhat You Should Know About Rising Mortgage Rates

Posted: February 28th, 2023

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may be wondering if now’s the right time to buy or if you should hold off on your search...

Read MoreOne Major Benefit of Investing in a Home

Posted: February 27th, 2023

One of the many reasons to buy a home is that it’s a major way to build wealth and gain financial stability. According to Freddie Mac: “Building equity through your monthly principal payments and appreciation is a critical part of homeownership that can help you create financial stability.” With spring approaching, now’s a great time to consider if buying a...

Read MoreChecklist for Selling Your House This Spring [INFOGRAPHIC]

Posted: February 24th, 2023

Some Highlights As you get ready to sell your house, there are specific things you can add to your to-do list. These include decluttering, taking down personal photos and items, and power washing outdoor surfaces. Let’s connect so you have advice on what you may want to do to get your house ready to sell this season.

Read MoreA Smaller Home Could Be Your Best Option

Posted: February 22nd, 2023

Many people are reaching the point in their lives when they need to decide where they want to live when they retire. If you’re a homeowner approaching this stage, you have several options to explore. Jessica Lautz, Deputy Chief Economist and Vice President of Research at the National Association of Realtors (NAR), says: “As we see the transition of the large Baby Boomer generation age...

Read MoreThe Two Big Issues the Housing Market’s Facing Right Now

Posted: February 21st, 2023

The biggest challenge the housing market faces is how few homes there are for sale. Mark Fleming, Chief Economist at First American, explains the root causes of today’s low supply: “Two dynamics are keeping existing-home inventory historically low – rate-locked existing homeowners and the fear of not finding something to buy.” Let’s break down these two...

Read MoreSpring into Action: Boost Your Home’s Curb Appeal with Expert Guidance

Posted: February 20th, 2023

To sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than at this time last year, but inventory is still historically low. So, if a house has been sitting on the market for a while, that’s a sign it may not be hitting the mark for potential buyers. But here’s the...

Read MoreThe Spring Housing Market Could Be a Sweet Spot for Sellers [INFOGRAPHIC]

Posted: February 17th, 2023

Some Highlights The biggest challenge in the housing market is how few houses there are for sale compared to the number of people who want to buy. The number of homes for sale is up from last year but below pre-pandemic numbers, and that means we’re still in a sellers’ market. The housing market needs more homes for sale to meet the demand of today’s buyers. If you’ve...

Read MoreWondering What’s Going on with Home Prices?

Posted: February 16th, 2023

The recent changes in home prices are top of mind for many as the housing market begins gearing up for spring. It can be hard to navigate misleading headlines and confusing data, so here’s what you should know about today’s home prices. Local price trends still vary by market. But looking at national data, Nataliya Polkovnichenko, Ph.D., Supervisory Economist at the Federal Housing...

Read MoreShould You Consider Buying a Newly Built Home?

Posted: February 15th, 2023

If you’re thinking about buying a home, you might be focusing on previously owned ones. But with so few houses for sale today, it makes sense to consider all your options, and that includes a home that’s newly built. The Number of Newly Built Homes Is on the Rise While there are more houses for sale right now than there were at this time last year, there’s still a historically low number...

Read MoreWhy It’s Easy To Fall in Love with Homeownership.

Posted: February 14th, 2023

No matter how the housing market changes, there are some things about owning a home that never changes—like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours. Over the last few years, we’ve fully embraced the meaning of our homes as we spent more...

Read MoreWhat You Should Know About Closing Costs.

Posted: February 13th, 2023

Before you buy a home, it’s important to plan ahead. While most buyers consider how much they need to save for a down payment, many are surprised by the closing costs they have to pay. To ensure you aren’t caught off guard when it’s time to close on your home, you need to understand what closing costs are and how much you should budget for. What Are Closing Costs? People are...

Read MoreHow To Win as a Buyer in Today’s Housing Market [INFOGRAPHIC]

Posted: February 10th, 2023

Some Highlights In today’s housing market, you can still be the champion if you have the right team and strategy. To win as a buyer, you need to build your team, make strategic plays, consider what’s in and out of bounds, and stand out from the crowd. Let’s connect today to make your game-winning play.

Read MoreWhy Today's Housing Market Isn't Headed for a Crash.

Posted: February 9th, 2023

67% of Americans say a housing market crash is imminent in the next three years. With all the talk in the media lately about shifts in the housing market, it makes sense why so many people feel this way. But there's good news. Current data shows today's market is nothing like it was before the housing crash in 2008. Back Then, Mortgage Standards Were Less Strict During the lead-up to the housing...

Read MoreNumber of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years.

Posted: February 8th, 2023

The biggest challenge in the housing market right now, and likely for years to come, is how few homes there are for sale compared to the number of people who want to buy. That's why, if you're thinking about selling your house, this is a great time to do so. Your house would be welcome in a market that has fewer homes for sale than it did in the years leading up to the pandemic. According to the...

Read MoreHow Experts Can Help Close the Gap in Today’s Homeownership Rate.

Posted: February 7th, 2023

As we celebrate Black History Month, we reflect on the past and present experiences of Black Americans. This includes the path toward investing in a home of their own. And while equitable access to housing has come a long way, homeownership can be a steeper climb for households of color. It’s an important experience to talk about, along with how it can make all the difference for diverse homebuyers to work...

Read MoreThe Top Reasons for Selling Your House.

Posted: February 6th, 2023

Many of today's homeowners bought or refinanced their homes during the pandemic when mortgage rates were at history-making lows. Since rates doubled in 2022, some of those homeowners put their plans to move on hold, not wanting to lose the low mortgage rate they have on their current house. And while today's rates have started coming down from last year's peak, they're still higher than they were a couple of years...

Read MoreYou May Not Need as Much as You Think for Your Down Payment [INFOGRAPHIC]

Posted: February 6th, 2023

Some Highlights Many people believe you need to put down 20% of the purchase price when you buy a home. But recent homebuyers actually put down far less on their purchase. And with programs like FHA loans, VA loans, and USDA loans, some qualified buyers are able to put down as little as 0-3.5%. Let's connect to make sure you have a trusted lender and can find out if...

Read MoreExperts Forecast a Turnaround in the Housing Market in 2023.

Posted: February 2nd, 2023

The housing market has gone through a lot of change recently, and much of that was a result of how quickly mortgage rates rose last year. Now, as we move through 2023, there are signs things are finally going to turn around. Home price appreciation is slowing from the recent frenzy, mortgage rates are coming down, inflation is easing, and overall market activity is starting to pick...

Read MoreShould You Rent Your House or Sell It?

Posted: February 1st, 2023

If you're a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they're an investment that's gained popularity in recent years. According to a Harris Poll survey, 28% of homeowners have considered using a rental service...

Read MoreLower Mortgage Rates Are Bringing Buyers Back to the Market.

Posted: January 31st, 2023

As mortgage rates rose last year, activity in the housing market slowed down. And as a result, homes started seeing fewer offers and stayed on the market longer. That meant some homeowners decided to press pause on selling. Now, however, rates are beginning to come down—and buyers are starting to reenter the market. In fact, the latest data from the Mortgage Bankers Association (MBA...

Read MoreWhere Will You Go If You Sell? You Have Options.

Posted: January 30th, 2023

There are plenty of good reasons you might be ready to move. No matter your motivations, before you list your current house, you need to consider where you'll go next. In today's market, it makes sense to explore all your options. That includes both homes that have been lived in before as well as newly built ones. To help you decide which is right for you, let's compare the benefits of each. Regardless...

Read MoreHomeownership Builds Your Wealth over Time [INFOGRAPHIC]

Posted: January 27th, 2023

Some Highlights If you're thinking of buying a home this year, be sure to factor in the long-term benefits of homeownership. On average, nationwide, home prices appreciated by 288.7% over the last 32 years. That means homeowners grow their net worth significantly in the long term. Homeownership wins over time. Let's connect so you can start your homebuying...

Read MoreWhy It Makes Sense To Move Before Spring.

Posted: January 26th, 2023

Spring is usually the busiest season in the housing market. Many buyers wait until then to make their move, believing it's the best time to find a home. However, that isn't always the case when you factor in the competition you could face with other buyers at that time of year. If you're ready to buy a home, here's why it makes sense to move before the spring market picks up. Spring Should Bring a Wave of Buyers...

Read MoreWhy You Shouldn't Fear Today's Foreclosure Headlines.

Posted: January 25th, 2023

If you've seen recent headlines about foreclosures surging in the housing market, you're certainly not alone. There's no doubt, the stories in the media can be pretty confusing right now. They may even make you think twice about buying a home for fear that prices could crash. The reality is, the data shows a foreclosure crisis is not where the market is headed, and understanding what that really means is...

Read MoreThe 3 Factors That Affect Home Affordability.

Posted: January 24th, 2023

If you've been following the housing market over the last couple of years, you've likely heard about growing affordability challenges. But according to experts, the key factors that determine housing affordability are projected to improve this year. Selma Hepp, Executive, Deputy Chief Economist at CoreLogic, shares: . . . with slowly improving affordability and a more optimistic economic outlook...

Read MoreWant To Sell Your House? Price It Right.

Posted: January 23rd, 2023

Last year, the housing market slowed down in response to higher mortgage rates, and that had an impact on home prices. If you're thinking of selling your house soon, that means you'll want to adjust your expectations accordingly. As realtor.com explains: . . . some of the more prominent pandemic trends have changed, so sellers might wish to adjust accordingly to get the best deal possible...

Read MoreWhat's Really Happening with Home Prices? [INFOGRAPHIC]

Posted: January 20th, 2023

Some Highlights If you're thinking about selling your house, recent headlines about home prices falling month-over-month may have you second-guessing your decision—but perspective matters. While home prices are down slightly month-over-month in some markets, home values are still up almost 10% nationally on a year-over-year basis. A nearly 10% gain is still dramatic...

Read MorePre-Approval in 2023: What You Need To Know.

Posted: January 19th, 2023

One of the first steps in your home-buying journey is getting pre-approved. To understand why it's such an important step, you need to understand what pre-approval is and what it does for you. Business Insider explains: In a preapproval [sic], the lender tells you which types of loans you may be eligible to take out, how much you may be approved to borrow, and what your rate...

Read MoreHave Home Values Hit Bottom?

Posted: January 18th, 2023

Whether you're already a homeowner or you're looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that's raising concerns about a repeat of what happened to prices in the crash in 2008. One of the questions that's on many minds, based on those headlines, is: how much will...

Read MoreThink Twice Before Waiting for 3% Mortgage Rates.

Posted: January 17th, 2023

Last year, the Federal Reserve took action to try to bring down inflation. In response to those efforts, mortgage rates jumped up rapidly from the record lows we saw in 2021, peaking at just over 7% last October. Hopeful buyers experienced a hit to their purchasing power as a result, and some decided to press pause on their plans. Today, the rate of inflation is starting to drop...

Read MoreWhat Past Recessions Tell Us About the Housing Market.

Posted: January 16th, 2023

It doesn't matter if you're someone who closely follows the economy or not, chances are you've heard whispers of an upcoming recession. Economic conditions are determined by a broad range of factors, so rather than explaining each in-depth, let's lean on the experts and what history tells us to see what could lie ahead. As Greg McBride, Chief Financial Analyst at Bankrate, says: Two-in-three economists...

Read MoreKey Terms To Know When Buying a Home [INFOGRAPHIC]

Posted: January 13th, 2023

Some Highlights Buying a home is a major transaction that can seem even more complex when you don't understand the terms used throughout the process. If you're looking to become a homeowner this year, it's important to know these housing terms and how they relate to the current market so you feel confident throughout the home-buying process. Let's connect so you have expert...

Read MoreIs It Time To Sell Your Second Home?

Posted: January 12th, 2023

During the pandemic, second homes became popular because of the rise in work-from-home flexibility. That's because owning a second home, especially in the luxury market, allowed those homeowners to spend more time in their favorite places or with different home features. Keep in mind, a luxury home isn't only defined by price. In a recent article, Investopedia shares additional factors that push a...

Read MoreToday's Housing Market Is Nothing Like 15 Years Ago.

Posted: January 11th, 2023

There's no doubt today's housing market is very different than the frenzied one from the past couple of years. In the second half of 2022, there was a dramatic shift in real estate, and it caused many people to make comparisons to the 2008 housing crisis. While there may be a few similarities, when looking at key variables now compared to the last housing cycle, there are significant differences. In the...

Read MoreThe Truth About Negative Home Equity Headlines.

Posted: January 10th, 2023

Home equity has been a hot topic in real estate news lately. And if you've been following along, you may have heard there's a growing number of homeowners with negative equity. But don't let those headlines scare you. In truth, the headlines don't give you all the information you really need to understand what's happening and at what scale. Let's break down one of the big equity stories you may...

Read MoreWhat Experts Are Saying About the 2023 Housing Market.

Posted: January 9th, 2023

If you're thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market this year. In 2022, the market underwent a major shift as economic uncertainty and higher mortgage rates reduced buyer demand, slowed the pace of home sales, and moderated home prices. But what about 2023? An article from HousingWire offers this...

Read MoreTips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC].

Posted: January 6th, 2023

Some Highlights If you're planning to buy a home in 2023, here are a few things to focus on. Work on your credit and save for a down payment. If saving feels like a challenge, there's help available. Then, get pre-approved, create a list of desired features, and prioritize them. Let's connect so you have expert advice on how to reach your homebuying...

Read More3 Best Practices for Selling Your House This Year.

Posted: January 5th, 2023

A new year brings with it the opportunity for new experiences. If that resonates with you because you're considering making a move, you're likely juggling a mix of excitement over your next home and a sense of attachment to your current one. A great way to ease some of those emotions and ensure you're feeling confident in your decision is to keep these three best practices in mind. 1. Price Your Home Right...

Read MoreAvoid the Rental Trap in 2023.

Posted: January 4th, 2023

If you're a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true costs of renting moving forward. In the past year, both current renters and new renters have seen their rent go up based on information from realtor.com: Three out of four...

Read MoreWondering How Much You Need To Save for a Down Payment?

Posted: January 4th, 2023

If you're getting ready to buy your first home, you're likely focused on saving up for everything that purchase involves. One cost that's likely top of mind is your down payment. But don’t let a common misconception about how much you need to save make the process harder than it could be. Understand 20% Isn't Always the Typical Down Payment Freddie Mac explains: . . . nearly a third of prospective...

Read MoreWhat Are Your Goals in the Housing Market This Year?

Posted: January 4th, 2023

If buying or selling a home is part of your dreams for 2023, it's essential for you to understand today's housing market, define your goals, and work with industry experts to bring your homeownership vision for the new year into focus. In the last year, high inflation had a big impact on the economy, the housing market, and likely on your wallet too. That's why it's critical to have a clear understanding...

Read MorePlanning To Sell Your House? It's Critical To Hire a Pro.

Posted: December 29th, 2022

With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you're thinking of selling your house, it's important to understand how the market has changed and what that means for you. The best way to make sure you're in the know is to work with a trusted housing market expert. Here are five reasons working with a professional can ensure you'll get...

Read MoreApplying For a Mortgage? Here's What You Should Avoid Once You Do.

Posted: December 28th, 2022

While it's exciting to start thinking about moving in and decorating after you've applied for your mortgage, there are some key things to keep in mind before you close. Here's a list of things you may not realize you need to avoid after applying for your home loan. Don't Deposit Large Sums of Cash Lenders need to source your money, and cash isn't easily traceable. Before you deposit...

Read MoreConfused About What's Going on in the Housing Market? Lean on a Professional.

Posted: December 27th, 2022

If you're thinking about buying or selling a home, you probably want to know what's really happening with home prices, mortgage rates, housing supply, and more. That's not an easy task considering how sensationalized headlines are today. Jay Thompson, Real Estate Industry Consultant, explains: Housing market headlines are everywhere. Many are quite sensational, ending with...

Read MoreFinancial Fundamentals for First-Time Homebuyers.

Posted: December 27th, 2022

Are you prepping to buy your first home? If so, one of the steps you should take early on is to make sure you're financially ready for your purchase. Here are just a few of the financial fundamentals you'll need to focus on as you set out to buy a home. Build Your Credit Your credit is one element that helps determine which home loan you'll qualify for. It also impacts your mortgage interest rate...

Read MoreWhat Makes a House a Home?

Posted: December 22nd, 2022

There's no denying the long-term financial benefits of owning a home, but today's housing market may have you wondering if now's still the time to buy. While the financial aspects of buying a home are important, the non-financial and emotional reasons are too. Home means something different to all of us. Whether it's sharing memories with loved ones at the kitchen table or settling in to...

Read MoreWhat To Expect From the Housing Market in 2023.

Posted: December 21st, 2022

The 2022 housing market has been defined by two key things: inflation and rapidly rising mortgage rates. And in many ways, it’s put the market into a reset position. As the Federal Reserve (the Fed) made moves this year to try to lower inflation, mortgage rates more than doubled – something that's never happened before in a calendar year. This had a cascading impact on buyer...

Read MoreHomeowners Still Have Positive Equity Gains over the Past 12 Months.

Posted: December 20th, 2022

If you're a homeowner, your net worth got a big boost over the past few years thanks to rapidly rising home prices. Here's how it happened and what it means for you, even as the market moderates. Equity is the current value of your home minus what you owe on the loan. Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over...

Read MoreMortgage Rates Are Dropping. What Does That Mean for You?

Posted: December 19th, 2022

Mortgage rates have been a hot topic in the housing market over the past 12 months. Compared to the beginning of 2022, rates have risen dramatically. Now they're dropping, and that has to do with everything happening in the economy. Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains it well by saying: Mortgage rates dropped even...

Read More2023 Housing Market Forecast [INFOGRAPHIC].

Posted: December 16th, 2022

Some Highlights From home sales to prices, the 2023 housing market will be defined by mortgage rates. And where rates go depends on what happens with inflation. If you're thinking of buying or selling a home this year, let's connect so you understand where the housing market is headed in 2023. Sources: realtor.com Home Price Expectations Survey (HPES) National Association of Realtors (NAR...

Read MorePlanning to Retire? It Could Be Time To Make a Move.

Posted: December 15th, 2022

If you're thinking about retirement or have already retired this year, you may be planning your next steps. One of your goals could be selling your house and finding a home that more closely fits your needs. Fortunately, you may be in a better position to make a move than you realize. Here are a few things to think about when making that decision. Consider How Long You've Been in Your Home From 1985...

Read MoreYou May Have More Negotiation Power When You Buy a Home Today.

Posted: December 14th, 2022

Did the frequency and intensity of bidding wars over the past two years make you put your home search on hold? If so, you should know the hyper-competitive market has cooled this year as buyer demand has moderated and housing supply has grown. Those two factors combined mean you may see less competition from other buyers. And with less competition comes more opportunity. Here are two...

Read MoreReady To Sell? Today's Housing Supply Gives You Two Opportunities.

Posted: December 13th, 2022

At first glance, the increase in housing supply compared to last year may not sound like good news for prospective sellers, but it actually gives you two key opportunities in today's housing market. An article from Calculated Risk helps put the inventory gains the market has seen in 2022 into perspective by comparing it to recent years (see graph below). It shows supply has surpassed...

Read MoreWhat Every Seller Should Know About Home Prices.

Posted: December 12th, 2022

If you're trying to decide whether or not to sell your house, recent headlines about home prices may be top of mind. And if those stories have you wondering what that means for your home's value, here's what you really need to know. What's Really Happening with Home Prices? It's possible you've seen news stories mentioning a drop in home values or home price depreciation, but it's important to remember those...

Read MoreReasons To Sell Your House This Season [INFOGRAPHIC]

Posted: December 9th, 2022

Some Highlights If you're planning to make a move but aren't sure if now's the right time, here are a few reasons why you shouldn't wait to sell your house. The supply of homes for sale, while growing, is still low today. Plus, serious buyers are out looking right now, and many are hoping to avoid falling into the rental trap for another year. Let's connect to determine if selling...

Read MoreHomeownership Is an Investment in Your Future

Posted: December 9th, 2022

There are many people thinking about buying a home, but with everything affecting the economy, some are wondering if it's a smart decision to buy now or if it makes more sense to wait it out. As Bob Broeksmit, President and CEO of the Mortgage Bankers Association (MBA), explains: The desire for homeownership is strong. Many prospective buyers are waiting for the volatility in mortgage rates to...

Read MoreKey Advantages of Buying a Home Today

Posted: December 8th, 2022

There’s no doubt buying a home today is different than it was over the past couple of years, and the shift in the market has led to advantages for buyers today. Right now, there are specific reasons that make this housing market attractive for those who’ve thought about buying but have sidelined their search due to rising mortgage rates. Buying a home in any market is a personal...

Read MoreMore People Are Finding the Benefits of Multigenerational Households Today

Posted: November 17th, 2022

If you're thinking of buying a home and living with siblings, parents, or grandparents, then multigenerational living may be for you. The Pew Research Center defines a multigenerational household as a home with two or more adult generations. And the number of individuals choosing multigenerational living has increased over the past 50 years. As you consider this option for your own home search, know it could help...

Read MoreTop Questions About Selling Your Home This Winter

Posted: November 17th, 2022

There's no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house. Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision. 1. Should I Wait To Sell? Even though the supply of homes for sale has increased in 2022, inventory is...

Read MoreHome Equity: A Source of Strength for Homeowners Today

Posted: November 16th, 2022

Experts agree there’s no chance of a large-scale foreclosure crisis like we saw back in 2008, and that’s good news for the housing market. As Mark Fleming, Chief Economist at First American, says: “. . . don’t expect a housing bust like the mid-2000s, as lending standards in this housing cycle have been much tighter and homeowners have historically high levels of home...

Read MoreWhy It May Be Time To Add Newly Built Homes to Your Search

Posted: November 16th, 2022

If you put a pause on your home search because you weren’t sure where you’d go once you sold your house, it might be a good time to get back into the market. If you’re willing to work with a trusted agent to consider a newly built home, you may have even more options and incentives than you realize. That may be why the National Association of Home Builders (NAHB) says the...

Read MoreWhat's Ahead for Mortgage Rates and Home Prices?

Posted: November 11th, 2022

Now that the end of 2022 is within sight, you may be wondering what's going to happen in the housing market next year and what that may mean if you're thinking about buying a home. Here's a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possible. Mortgage Rates Will Continue To Respond to Inflation There's no doubt mortgage rates have...

Read MoreVA Loans Can Help Veterans Achieve Their Dream of Homeownership

Posted: November 11th, 2022

For over 78 years, Veterans Affairs (VA) home loans have provided millions of veterans with the opportunity to purchase homes of their own. If you or a loved one have served, it's important to understand this program and its benefits. Here are some things you should know about VA loans before you start the homebuying process. What Are VA Loans? VA home loans provide a pathway to homeownership for those who have...

Read MoreThe Cost of Waiting for Mortgage Rates To Go Down

Posted: October 29th, 2022

Mortgage rates have increased significantly in recent weeks. And that may mean you have questions about what this means for you if you're planning to buy a home. Here's some information that can help you make an informed decision when you set your homebuying plans. The Impact of Rising Mortgage Rates As mortgage rates rise, they impact your purchasing power by raising the cost of buying a home and limiting how...

Read MoreHow To Prep Your House for Sale This Fall

Posted: October 29th, 2022

Today's housing market is different than it was just a few months ago. And if you're thinking about selling your house, that may leave you wondering what you need to do differently as a result. The answer is simple. Taking the time upfront to prep your house appropriately and create a solid plan can help bring in the greatest return on your investment. Here are a few simple tips to make sure you maximize the sale...

Read MoreThink Home Prices Are Going To Fall? Think Again

Posted: August 9th, 2022

Over the last two years, the rate of home prices appreciated at a dramatic pace. While that led to incredible equity gainsfor homeowners, it's also caused some buyers to wonder if home prices will fall. It's important to know the housing market isn't a bubble about to burst, and home price growth is supported by strong market fundamentals. To understand why price declines are unlikely, it's important to explore...

Read MoreShould You Buy a Home with Inflation This High?

Posted: August 9th, 2022

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still going up. You no doubt are feeling the pinch on your wallet at the gas pump or the grocery store, but that news may also leave you wondering: should I still buy a home right now? Greg McBride, Chief Financial Analyst at Bankrate, explains how inflation is affecting the housing market: Inflation will...

Read MoreWhy Pre-Approval Is a Game Changer for Homebuyers

Posted: August 9th, 2022

If you're planning to buy a home this year, you might have heard that pre-approval is a necessary step to take before starting out on your journey. But why is that? And is it still important in today's shifting market? The truth is, getting a pre-approval letter from your lender is critical, and when it comes to your home search, it can be a game changer in so many ways. To better understand why, it's important to...

Read MoreWondering Where You’ll Move if You Sell Your House Today?

Posted: July 25th, 2022

If you put a pause on your home search because you weren't sure where you'd go once you sold your house, it might be a good time to get back into the market. That's because today's market is undergoing a shift, and the supply of homes for sale is increasing as a result. That means you may have a better chance of finding a home that will meet your current needs. Here are some options to consider. Buying an Existing...

Read MoreShould I Rent or Should I Buy?

Posted: July 25th, 2022

Some Highlights It’s worth considering the many benefits of homeownership before you make the decision to rent or buy a home. When you buy, you can stabilize your housing costs, own a tangible asset, and grow your net worth as you gain equity. When you rent, you face rising housing costs, won’t see a return on your investment, and limit your ability to save. If you...

Read MoreHousing Experts Say This Isn’t a Bubble

Posted: July 25th, 2022

With so much talk about an economic slowdown, some people are asking if the housing market is heading for a crash like the one in 2008. To really understand what’s happening with real estate today, it’s important to lean on the experts for reliable information. Here’s why economists and industry experts say the housing market is not a bubble ready to pop. Today...

Read MoreShould I Buy a Home Right Now?

Posted: July 20th, 2022

If you've been thinking about buying a home, you likely have one question on the top of your mind: should I buy right now, or should I wait? While no one can answer that question for you, here's some information that could help you make your decision. The Future of Home Price Appreciation Each quarter, Pulsenomics surveys a national panel of over 100 economists, real estate experts, and investment and market...

Read MoreExpert Housing Market Forecasts for the Second Half of the Year

Posted: July 18th, 2022

The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help answer those questions, let’s turn to the experts for projections on what the second half of the year holds for residential real estate. Where Mortgage Rates Will Go Depends on...

Read MoreThe Drop in Mortgage Rates Brings Good News for Homebuyers

Posted: July 18th, 2022

Over the past few weeks, the average 30-year fixed mortgage rate from Freddie Mac fell by half a percent. The drop happened over concerns about a potential recession. And since mortgage rates have risen dramatically this year, homebuyers across the country should see this decline as welcome news. Freddie Mac reports that the average 30-year rate was down to 5.30% from 5.81% two weeks prior (see...

Read MoreWhat Does an Economic Slowdown Mean for the Housing Market?

Posted: July 7th, 2022

According to a recent survey, more and more Americans are concerned about a possible recession. Those concerns were validated when the Federal Reserve met and confirmed they were strongly committed to bringing down inflation. And, in order to do so, they'd use their tools and influence to slow down the economy. All of this brings up many fears and questions around how it might affect our lives, our jobs, and...

Read MoreHow Your Equity Can Grow over Time

Posted: July 6th, 2022

It's true that record levels of home price appreciation have spurred significant equity gains for homeowners over the past few years. As Diana Olick, Real Estate Correspondent at CNBC, says: The stunning jump in home values over the course of the Covid-19 pandemic has given U.S. homeowners record amounts of housing wealth. That's great for your home's value over the last couple of years, but what if you've lived...

Read MoreIs Homeownership Still the American Dream?

Posted: July 6th, 2022

Defining the American dream is personal, and no one individual will have the same definition as another. But the feelings it brings about – success, freedom, and a sense of prosperity – are universal. That's why, for many people, homeownership remains a key part of the American dream. Your home is your stake in the community, a strong financial investment, and an achievement to be proud of. A recent...

Read MoreIf You're Selling Your House This Summer, Hiring a Pro Is Critical

Posted: June 30th, 2022

It can be tempting, especially with how hot the housing market has been over the past two years, to consider selling your home on your own. But today's market is at a turning point, making it more essential than ever to work with a real estate professional. Not only will a trusted real estate advisor keep you updated and help you make the best decisions based on current market trends, but they're also experts in...

Read MoreHomeownership Could Be in Reach with Down Payment Assistance Programs

Posted: June 29th, 2022

A recent survey from Bankrate asks prospective buyers to identify the biggest obstacles in their homebuying journey. It found that 36% of those polled said saving for a down payment is one of their primary hurdles to buying a home. If you feel the same way, the good news is there are many down payment assistance programs available that can help you achieve your homeownership goals. The key is...

Read MoreTwo Reasons Why Today's Housing Market Isn't a Bubble

Posted: June 28th, 2022

You may be reading headlines and hearing talk about a potential housing bubble or a crash, but it's important to understand that the data and expert opinions tell a different story. A recent survey from Pulsenomics asked over one hundred housing market experts and real estate economists if they believe the housing market is in a bubble. The results indicate most experts don't think that's the case (see graph...

Read MoreA Key Opportunity for Homebuyers

Posted: June 28th, 2022